For those of you who are stumped about gifts this holiday there is probably a reason. You ask yourself- what do we actually need? Amidst all of the news of poverty and destruction, most of us find ourselves in the upper economy and hopefully and simply grateful for what we have already. Our culture has created an opportunity to jot objects on our wish list that we think we need or really want. Now don’t get me wrong, there is beauty in giving a gift to someone you care about whom you know will appreciate it. But, if you want to maintain your spirit of giving this year yet do it in an alternative fashion, why not try giving together with someone you care about to someone who will appreciate it?

For those of you who are stumped about gifts this holiday there is probably a reason. You ask yourself- what do we actually need? Amidst all of the news of poverty and destruction, most of us find ourselves in the upper economy and hopefully and simply grateful for what we have already. Our culture has created an opportunity to jot objects on our wish list that we think we need or really want. Now don’t get me wrong, there is beauty in giving a gift to someone you care about whom you know will appreciate it. But, if you want to maintain your spirit of giving this year yet do it in an alternative fashion, why not try giving together with someone you care about to someone who will appreciate it?

For the past five + years my family has been practicing different ways of sharing gifts for the holidays. We made gifts a couple of years. Then we decided to pool our funds and purchase one big gift for someone in the family that would inspire their lifestyle, creativity, and passion… This year we decided that no one really need anything and we would prefer to do something together as a family to improve the lives and economies of others- invest in a micro-fund.

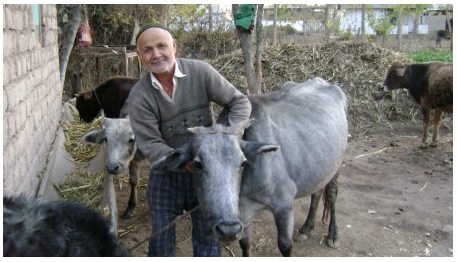

Microfinance creates social lending networks that gives us lenders the opportunity to connect directly with borrowers who normally wouldn’t get the support of a bank. This allows people in poor countries and rural areas who don’t have access to traditional banks or don’t have the credentials necessary for a bank loan, to start a business. The neat things it that in all circumstances (weather your money is controlled by the organization through which you lend or you choose who your money goes to) you can more or less track your loan. This type of investment has already made profound impacts on developing nations as it funds businesses that support their local economies. Instead of weaving baskets to be sold in the global market, people are able to start water distribution businesses to improve quality of life in their own communities.

Taken from Ode Magazine an article on Microfinance, “It is the goal of getting capital to people who need it at reasonable rates that creates a strong sense of purpose and community in social lending. The sites promote personal ties between lenders and borrowers. And with the global reach of the Internet, borrowers no longer need to know someone with money to secure a loan. By the same token, lenders often feel they’re helping a real person get through a bad patch or realize a dream.”

That being said, here are a few options for you:

KIVA

“Kiva lets you lend to a specific entrepreneur in the developing world – empowering them to lift themselves out of poverty.”

PLANET FINANCE

“Providing people with the means to construct their own future.”

OPPORTUNITY INTERNATIONAL

“Opportunity International provides small microfinance loans — sometimes as little as $50 — as well as banking, insurance and other financial services that allow poor entrepreneurs to start or expand a business, develop a steady income, provide nutritious meals and education for their children and create jobs for their neighbors.”

PROSPER

“People who need money request it, and other people bid for the privilege of lending it to them. Prosper makes sure everything is safe, fair and easy.”

For Individual Modest Gift Giving:

Kyle Weatherholtz

I think this is a great post and a good alternative to wrapping paper and bows flying off of presents and right into trash cans.

last year I gave my family members all things we could eat that day. My brother loved the big block of sharp cheddar cheese.